The housing crisis is a nationwide problem that needs to be addressed. The rate at which new homes are being constructed has drastically declined over the past few years. Leaving many people in search of somewhere affordable to live and creating a market demand that will take years to fulfill.

The original cause of the housing supply crisis is widely understood. After the 2008 Great Recession, new home construction dropped like a stone. Fewer new homes were built in the 10 years prior to 2018 than in any decade since the 1960s. By 2019, a good estimate of the shortage of housing units for sale or rent was 3.8 million.

The Shortage Beginnings

Record low interest rates, the pandemic coupled with more than a decade of under building created a supply and demand mismatch that has not been seen since the GI’s came home from WWII, pushing home prices even higher. By 2022 the US has fallen behind by about 5.5 million housing units as builders failed to keep up with historical building trends.

Other Forces Causing the Shortage

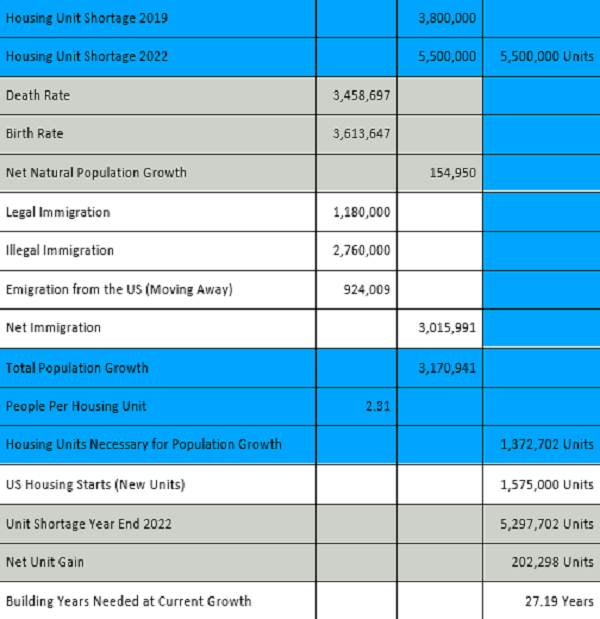

Other forces pushing on the shortage of housing units in the US are simply the birth rate, the death rate, legal immigration, illegal immigration, emigration away from the US, and number of housing starts that are possible to build in the US market each year. (See chart)

As stated in 2019 it was estimated that there was a 3.8-million-unit housing shortage as a result of the lack of building from 2008 to 2019.

The building began to tick up and then the pandemic hit and wreaked havoc on building and the supply chain. This limited housing starts but it’s only one of the problems.

Our natural population growth has slightly declined for several years but has now also ticked back up in the last year.

Immigration Both Legal and Illegal

Immigration both legal and illegal is the biggest factor of the unit shortage we are experiencing. The US housing shortage estimate is 5.5 million units by 2022.

As you can see from the chart, assuming all given immigration stats are correct,

1. There is a new demand of 1.372 million housing units each year.

2. New housing starts unit starts equaled 1.575 million units in 2022 reducing the shortage by 202,298 units.

3. This means at the current rate all things being equal it will take 27 years to build out of the shortage.

I understand that we are using a lot of running data to take a snapshot of one year to look at this, but there’s a few things that are obviously true.

If illegal immigration came to a screeching halt, and legal immigration and population growth remained the same. It would still take five years of the current home building trends to build us out of the demand.

Effect on Current Prices

This shortage has had its effect on the current housing stocks as well, with existing home prices in the United States soaring 45 percent from December 2019 to June 2022, when Covid emerged and then gripped the nation.

According to Forbes this increase has not been seen in over 45 years.

Recession/No Recession … That is the Question

I’ve been looking at these numbers for some time, and as I hear a constant barrage of negative economic stats, mostly from the media, I keep asking, why is this market so different?

There are all types of predictions that a recession is coming, I’m not in the predicting business, and believe that a recession could be around the corner. (Watch your stocks closely.)

I Have Yet to Meet the Prognosticators That Predicted a 45% Increase in Home Value

When you look at the housing price indicators/charts you will see that the rise in prices mirrors the rise in prices in 2008. There’s one drastic difference, the current shortage of inventory did not exist in 2008. There was a glut of inventory being built throughout the United States. The prognosticators did not predict the housing crash of 2008 and I have yet to meet the prognosticator that predicted a 45% increase in home value over the last two years. All I’ve heard since 2019 is this market doesn’t feel right it must be going to crash. I can almost not wait to see if they are right, but I will not hold my breath. I like living!

Before you protest, yes, the changes in interest rates will affect the market to some degree, but by the math the actual physical shortage of real estate will be here with us for some time.

There Has Never Been a Better Time to Be in Real Estate!

Thanks for reading, Joshua A. Dudgeon

Founder / CEO

Real Estate Investment Results